Apply for a monthly payout fund

Liquid fund is exactly the same as a Fixed Deposit but with advantages, see table below

| Savings A/c | Fixed Deposit | Liquid fund | |

| Capital guaranteed | Yes | Yes | Yes |

| Interest rate | 3% | 7-9% | 7-9% |

| Minimum Time | 1 day | 1 year | 1 week |

|

Held with who? Example |

Bank HDFC, Axis, ICICI |

Bank HDFC, Axis, ICICI |

Mutual Fund house Birla, HDFC, UTI |

| Paperwork when withdrawing | Required | Required | Mobile OTP or Email |

| Safety of transaction | FD proceeds returned only to your SB a/c | Same | |

| Time for FD withdrawal to reach SB a/c | 3-7 days | 1-2days | |

| Minimum amount | 20,000 | 50,000 | 5,000 |

| Tax | Tax free for NRE | Tax free for NRE | Tax free for NRE |

When can I use Liquid funds

- Persons who have received a large bonus

- persons who have just sold a property

- as booster for SSIP and SIP

- as contigency fund, i.e. we advise clients to maintain 3 months income in Liq funds for emergencies. If the money is in a SB a/c, persons are tempted to spend it

Examples of Liquid Funds

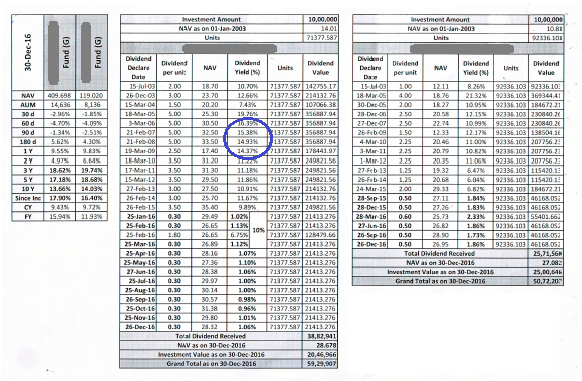

Save 40,000 a year on average

If an individual has 10 Lakhs lying idle in their SB a/c they will be loosing about 40,000 Rs per year in interest. The same idle funds if parked in a Liquid fund would give a much higher return. See table below. Liquid funds are 100% SAFE, exactly like Fixed Deposits, but with the facility to withdraw anytime without loss of interest or penalty, hence the name 'Liquid' fund.

Choose the right Liquid Funds to minimize Tax

| Funds from |

Interest in SB A/c |

Interest in Liq fund G |

Interest in Liq fund DDRI |

||||

| NRE | 1,000,000 | 40,000 | (4% less TDS) | 88,200 | (8.8% less TDS) | 63,000 | (6.3% Tax Free) |

| NRO | 1,000,000 | 40,000 | (4% less TDS) | 88,200 | (8.8% less TDS) | 63,000 | (6.3% Tax Free) |

| Resident | 1,000,000 | 40,000 | (File tax return) | 88,200 | (File tax return) | 63,000 |

(File tax return) |

The bold blue items are recommended. Interest figures shown are indicative as of July 2015 and must be rechecked with scheme documents at the time of investmenthey have

Deca

Deca